arizona solar tax credit 2019

Web Interest may be tax-deductible. Web Zillow Homes with Solar Panels Sell for 41 More a comparison of home values with and without solar in New York NY Orlando FL San Francisco CA Los Angeles CA and Riverside CA.

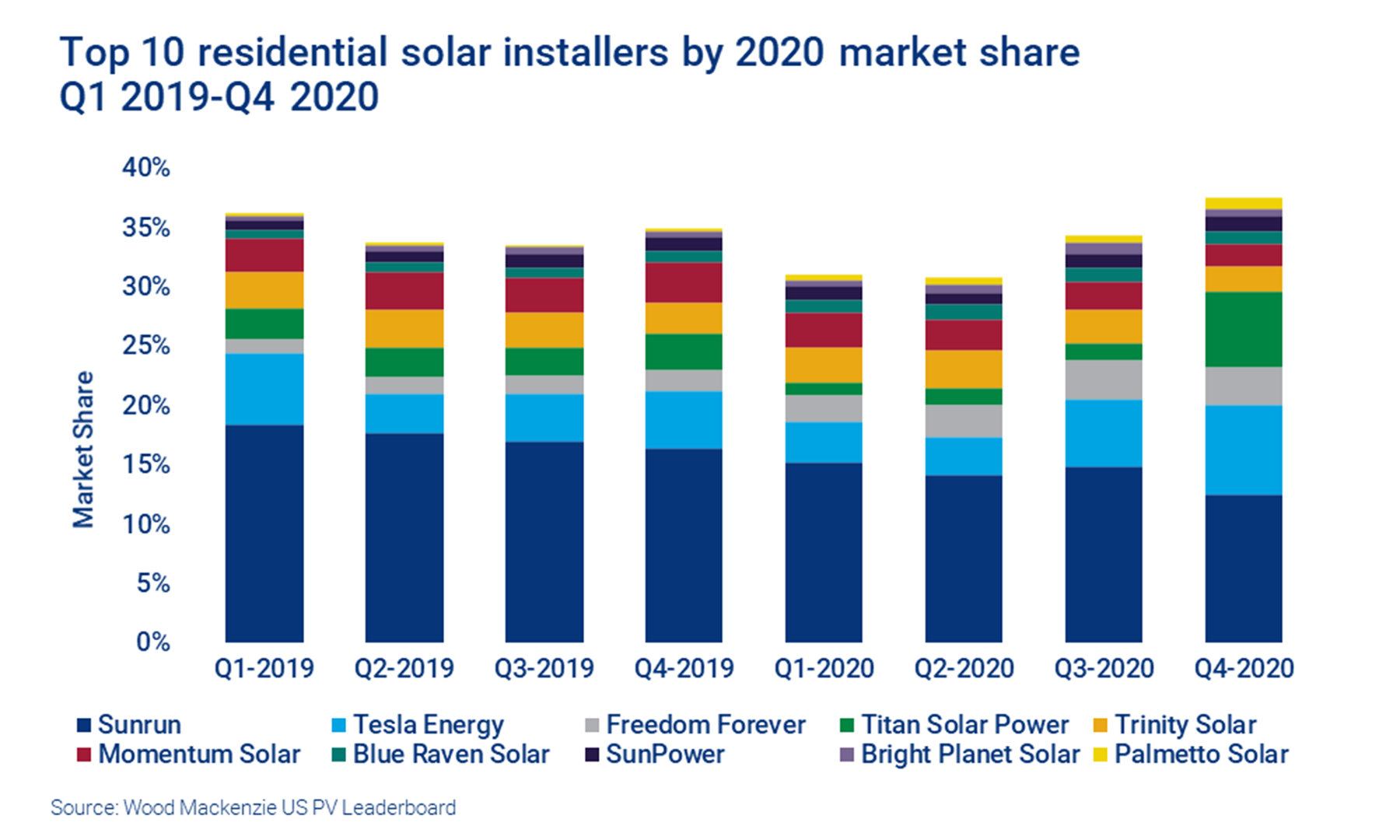

Sunrun Retains Its Title As Largest Residential Solar Installer In The Us Wood Mackenzie

The size of your solar panel system among other factors influences the number of kilowatt-hours kWh that are produced.

. Call us at 520 399-8233 to produce green energy. Then the pandemic hit and we werent sure what was going to happen to our business. Joint Tax Application for a TPT License.

Web If you credit is greater than your tax liability it will not generate a tax refund. Web Arizona solar tax credit. Starwood Energy acquired the project from Con Edison Development in 2021.

Web In this EcoWatch guide on the California solar tax credit youll learn. Crane was part of a portfolio that also included Coram Wind which was sold in December 2021. Every resident in Arizona who installs solar panels gets a state tax credit of 25 of the total system cost up to 1000 to be used toward State income taxes.

This is due to newswire licensing terms. Web The Size of Your Solar Panel System. Ill just be paying the minimum on my electricity.

Fort Collins offers a 250kW incentive up to 1000 filed on. Web Well get to the best way to clean your solar panels in a minute. Instead of paying our electricity bill were paying for our solar system.

Transaction Privilege Tax Election for Accounting and Reporting Expenses Credit. Created by the Federal Housing Administration the PowerSaver helps individuals make cost and energy effective improvements to their homes including the installation of solar power systems. Photovoltaic cells convert light into an electric current using the photovoltaic effect.

In 2021 it dropped further to 22 then 10 in 2022. Web Enjoy millions of the latest Android apps games music movies TV books magazines more. Web Get the highest efficiency home solar panels available from an industry leader.

But first lets look at when and why you might need to invest in solar panel cleaning equipment or hire a professional cleaning service. Local and Utility Incentives. This type of exemption helps to reduce the upfront costs of a solar installation.

Fortunately the Geothermal Tax Credit allows homeowners to apply their tax credit over multiple years. Information Administration shows that the state accounted for nearly 45 of the nations small-scale residential solar energy generation in 2019. Most residential solar panel systems are anywhere from 5 to 10 kilowatts kW.

Web Arizona transaction privilege tax TPT is a tax on the vendor for the privilege of doing business in the state. At the beginning of 2020 the tax credit dropped to 26. Solar panels arent just good for the environment you can benefit from serious savings which can vary based on a number of factors including your location current energy usage trends and the solar panel system.

Web People thinking about going solar they need to think about how energy is going to increase in the coming years and once I pay off this system thats it. Cities and states across the US also offer incentives for solar. The RCP rate allows customers to receive a credit for excess energy sent to the grid.

Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger. Tax credits subject to change. The federal solar tax credit also known as the solar investment tax credit or ITC offers new solar owners in the United States a tax credit equal to 26 of costs they paid for their solar installation.

Web Here are the ones most commonly used by homeowners to reduce their solar panel costs and shorten their solar payback period. Before filing ensure you have all documentation as some tax statements are not required to be sent until January 31 such as W-2s 1099s and annual tax summaries. Some of the most common types of solar energy loans are.

The federal tax credit isnt the only incentive to help bring down your solar expenses. SunPower does not warrant guarantee or otherwise advise its partners or customers about specific tax outcomes. Web The article you have been looking for has expired and is not longer available on our system.

Google did a study on the need to clean solar panels. Web Sales tax incentives typically provide an exemption from the state sales tax or sales and use tax for the purchase of a solar energy system. Concentrated solar power systems use lenses or mirrors and solar tracking systems to focus a large area of.

New Mexicos solar tax credit is back with big savings Catherine Lane. Web Electric Vehicles Solar and Energy Storage. After that its toast.

Web Most solar shoppers can save between 10000 and 30000 on electricity over the lifetime of a solar panel system. Any bill credit in excess of the customers otherwise applicable monthly bill will be credited on. Web The State of Arizonas individual income tax filing season has launched and is now accepting electronically filed 2021 income tax returns.

HERO Program Catherine Lane. The size of your solar panel system has a direct impact on your monthly electric bill. At the time of writing December 2019 no other consumer website can do this.

They found that tilted panels dont require cleaning as much as flat panels. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit. Department of Housing and Urban Development.

We contracted w TFS at the end of 2019. The only other place such accurate functionality is available is in professional. Consult your tax advisor regarding the solar tax credit and how it applies to your specific circumstances.

If your tax bill is 300 but your non-refundable tax credit is 1000 you will only use 300 of your credit and will have 700 unused. Based on search of datasheet values from websites of top 10 manufacturers per IHS as of January 2017. Nevada Solar Incentives Arizona Solar Incentives New Mexico Solar Incentives Utah Solar Incentives Idaho Solar.

Web Solar power is the conversion of energy from sunlight into electricity either directly using photovoltaics PV indirectly using concentrated solar power or a combination. Learn about 0 down financing. Web 2019 was the last year for the full 30 credit.

Anytime anywhere across your devices. Web Crane located in Crane County TX is a 150MW AC solar project that sells energy and renewable energy credits to a subsidiary of Vistra Corporation under a PPA through 2032. TFS was willing to put the.

There are 25 states that offer sales tax exemptions for solar energy. Web It depends on the solar rate you choose - RCP or EPR-2. Web Get our solar panel installation in Tucson AZ and take advantage of our discounts.

Arizona for example provides a sales tax.

Southeast Us Adds 427 Mw Of Distributed Solar In 2019 As Advocates Press For More Pv Magazine Usa Energy Plan Solar News Solar Program

Free Solar Panels Arizona What S The Catch How To Get

Solar Energy Incentive Programs Are Your Friends Mother Earth News Solar Panel Installation Solar Panels Solar Panels For Home

The Ultimate 2020 Guide To California Solar Tax Credit And Incentives

How Your Business Can Claim The Solar Tax Credit Legalzoom

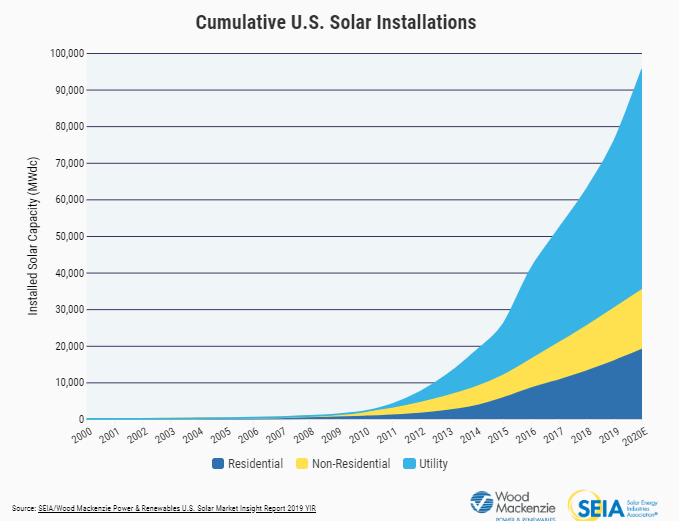

2019 Was A Record Year For U S Solar Power Wells Solar

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

The Federal Solar Tax Credit Has Been Extended Through 2023 Ecohouse Solar Llc

Solar Energy Evolution And Diffusion Studies Webinars Solar Market Research And Analysis Nrel

Solar Tax Credit Details H R Block

The Extended 26 Solar Tax Credit Critical Factors To Know

How Much Do Commercial Solar Panels Cost Kake

How To Calculate The Federal Solar Investment Tax Credit Duke Energy Sustainable Solutions

Solar Tax Credit 2021 Extension What You Need To Know Energysage

Salt River Tubing Fun In The Sun Salt River Tubing Tubing River Fun

Federal Solar Tax Credit How It Works Explained In Plain English Sun Source Homes